A platform built for personal, virtual customer interactions

One-click video chatting on any browser or device

Customers shouldn’t have to learn how to use your video tool, so our solution works in one-click on any browser or device. No installation or download required.

Keep discussions private and compliant

The Bird Video platform is ISO 27001 certified, GDPR proof, PCI compliant and regularly PEN-tested. Plus, we encrypt the limited data stored by the platform with AES-256 encryption.

Bespoke to your brand and business

Whitelabel the platform to match the look and feel of your brand. Customize your links, color palette, logo treatment, and more.

Turn physical appointments into digital experiences

Banking

Through personal video calls, screen- and document-sharing, agents are fully equipped to explain and offer financial products.

Insurance

Let agents focus on building customer relationships while automation features take care of repetitive administration.

Healthcare

Video chatting for administering telehealth and staying connected with patients when in-person visits present a risk.

Public Sector

Manage public sector appointments and take care of business virtually with secure, encrypted video and content sharing.

Automate routine work, get deep insights, continue to delight customers

Create video calls that comply with your workflows, security requirements and customer journeys. Bird Video is 100% configurable

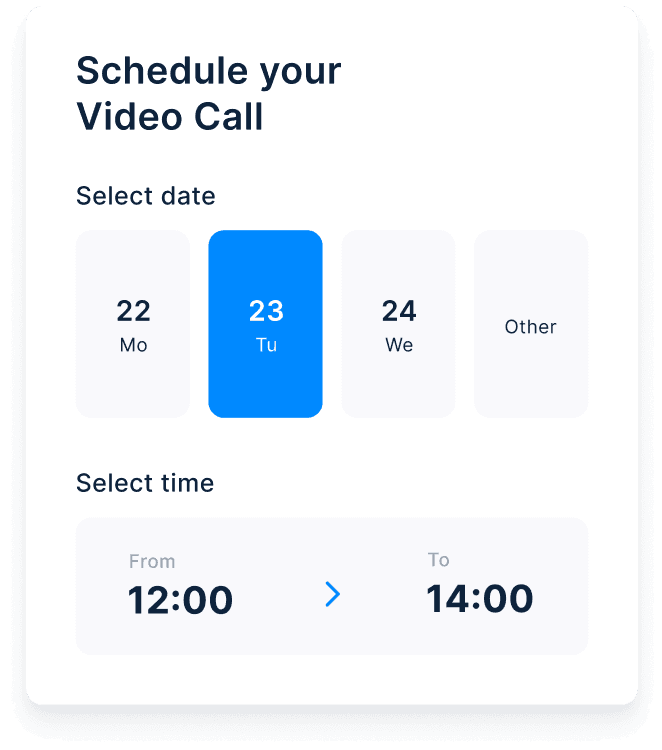

Meeting Management

Maximize availability while minimizing no-shows, with Smart Availability, built-in scheduling, and integrations for every calendar.

Notifications and Reminders

Automatically send appointment confirmations and reminders via Email and SMS.

Reviews & Feedback

After the call, ask feedback questions for NPS, CSAT, and more.

Put your data to work

Out of the box dashboards give you general insights or use the API for custom queries.

Real-time communication

Both participants can share their screens, send documents, and respond via live chat.

Intelligence

Automate reports with transcriptions, compliance tracking, and call analytics.